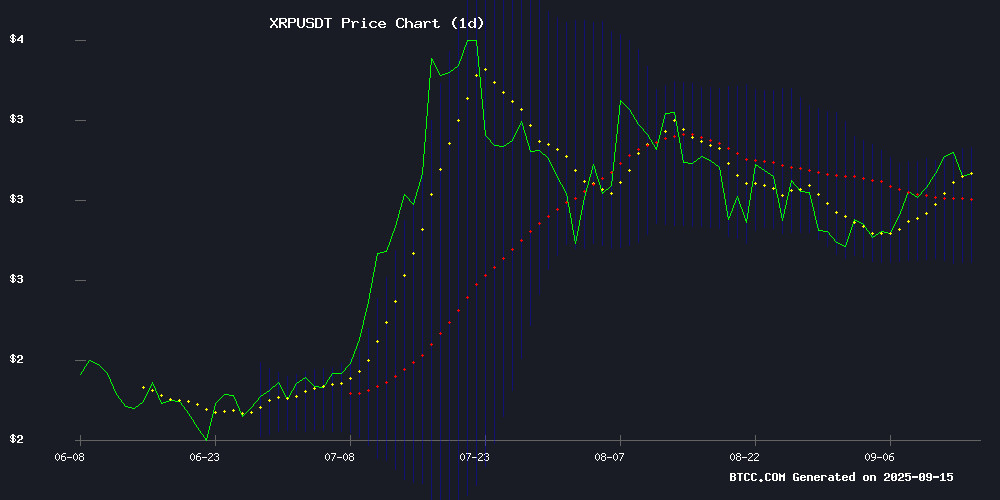

XRP Price Prediction: Analyzing the Path to $4 Amid Bullish Technicals and Growing Institutional Adoption

#XRP

- Technical Breakout Configuration: XRP trading above 20-day MA with Bollinger Bands suggesting upward momentum toward $3.13 resistance

- Institutional Adoption Catalyst: Market capitalization surpassing Citigroup and Ripple's tokenization forecasts creating fundamental support

- Volume and Momentum Indicators: 200% trading volume explosion combined with mixed but improving MACD signals supporting continued upward movement

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Above Key Moving Average

XRP is currently trading at $2.9765, positioned above its 20-day moving average of $2.9140, indicating underlying strength. The MACD reading of -0.0693 | 0.0189 | -0.0882 shows mixed signals with the histogram remaining negative, though the signal line suggests potential momentum building. Bollinger Bands configuration with upper at $3.1291, middle at $2.9140, and lower at $2.6988 places the current price in the upper band range, suggesting possible overbought conditions but also demonstrating strong buying interest.

According to BTCC financial analyst Michael, 'The technical setup suggests consolidation with a bullish bias. Holding above the 20-day MA is crucial for maintaining upward momentum toward the $3.13 resistance level.'

Market Sentiment: Institutional Adoption Fuels XRP Optimism Despite Resistance

Recent news headlines reflect overwhelmingly positive sentiment toward XRP, highlighting its surge past key resistance levels and market capitalization surpassing traditional financial giant Citigroup. The 9% price correction is being viewed as healthy consolidation rather than a bearish reversal, with multiple analysts projecting targets of $3.40 and beyond.

BTCC financial analyst Michael notes, 'The combination of Ripple's projections for 10% global asset tokenization by 2030 and exploding trading volume—up 200%—creates a fundamentally strong backdrop. However, institutional selling at the $3 resistance level requires monitoring as it may cause short-term volatility before the next leg up.'

Factors Influencing XRP's Price

XRP Price Correction of 9% Could Set the Stage for a Rally — Here’s How

XRP's recent 9% price correction may lay the groundwork for a bullish reversal, contingent on key support levels holding. Derivatives data reveals aggressive sellers dominating futures trading, with the taker buy-sell ratio dropping to 0.84 — its lowest in a month. This imbalance mirrors late August's setup, which preceded a 7% decline.

Spot market activity compounds the bearish signals. Binance withdrawals for XRP plummeted 97% from 15,648 transactions on September 11 to just 498, indicating weakening holder conviction. The confluence of futures positioning and stagnant spot flows suggests near-term pressure, though historical patterns show such conditions often precede relief rallies.

XRP Surges Past Key Resistance With $3.4 Target in Sight

XRP has broken above a multi-month falling wedge pattern after finding solid support at $2.7 near the 100-day moving average. The cryptocurrency now faces initial resistance at $3.0, with key upside targets at $3.4 and $3.6 if bullish momentum continues.

Technical analysts anticipate a potential pullback to retest the broken wedge level at $2.9 before further upward movement. Daily chart analysis reveals XRP found crucial support from the convergence of the 100-day moving average and the falling wedge's lower boundary, fueling renewed buying interest.

The breakout marks a decisive shift from recent descending price action. Market participants should expect consolidation or a corrective pullback as the asset digests gains. A successful hold above $2.9 WOULD strengthen the case for continued upside.

XRP Price Pullback – Bulls Step In, $3.00 Remains Safe (For Now)

XRP price shows resilience as it consolidates above the $3.00 support level, despite a recent pullback from the $3.186 high. The cryptocurrency briefly breached the $3.150 resistance before encountering selling pressure, leading to a break below the 100-hourly Simple Moving Average.

Market observers note key technical developments, including the breach of a bullish trend line at $3.080 on the XRP/USD hourly chart. The 50% Fibonacci retracement level of the recent upward MOVE from $2.9365 to $3.186 has also been tested. Bulls remain active, defending the crucial $3.00 psychological level that could determine the next directional move.

Immediate resistance now stands at $3.0620, with more significant hurdles at $3.080. A sustained hold above $3.00 could pave the way for another attempt at higher price levels, while failure to maintain this support might trigger deeper correction.

XRP Surpasses Citigroup in Market Capitalization, Signaling Shift in Financial Landscape

XRP has achieved a historic milestone by overtaking banking giant Citigroup in market capitalization, with its valuation reaching $184.20 billion compared to Citigroup's $183.62 billion. This marks the first time a cryptocurrency has surpassed a major Wall Street institution by market value, underscoring the growing influence of digital assets in traditional finance.

The achievement positions XRP as the 94th most valuable asset globally, reflecting heightened credibility for cryptocurrencies in mainstream markets. Beyond numerical comparisons, this development symbolizes the accelerating integration of digital assets into established financial structures. XRP's role as a global payment system and liquidity provider now rivals one of America's largest banks, signaling a transformative shift in financial intermediation.

This watershed moment highlights the increasing institutional adoption of cryptocurrencies and their potential to reshape the financial ecosystem. The market's recognition of XRP's value at parity with traditional banking powerhouses demonstrates the maturing perception of digital assets as legitimate financial instruments.

Ripple Forecasts 10% Global Asset Tokenization by 2030, Citing $16T Custody Boom

Ripple's latest projection positions tokenization as the next frontier in institutional finance, with 10% of global assets expected to migrate to blockchain rails by 2030. The $16 trillion custody market forecast underscores how traditional finance giants are embracing digital infrastructure.

Société Générale's EURCV stablecoin issuance on the XRP Ledger through Ripple Custody demonstrates real-world adoption. Asian markets follow suit, with South Korea's BDACS utilizing the same infrastructure for Ripple USD (RLUSD) management.

The custody sector emerges as the linchpin of institutional participation, enabling secure holding of tokenized real estate, treasuries and cryptocurrencies. This infrastructure buildout suggests blockchain is transitioning from speculative asset class to foundational financial plumbing.

XRP Price Speculation Reaches New Heights Amid Institutional Adoption Scenarios

Ripple's XRP remains a focal point of speculative fervor, with analysts projecting price targets ranging from $100 to $1 million. The token's institutional utility as a cross-border payment bridge continues to fuel bullish narratives, despite muted recent price action.

Analyst 'Pumpius' outlines two key adoption scenarios: XRP reaching $50 if adopted by banks for custody and treasury operations, or $100 with accelerated corporate uptake. These projections hinge on Ripple's ongoing efforts to position XRP as a global settlement asset.

Market observers note growing retail interest in XRP alongside its institutional positioning. The cryptocurrency's potential to facilitate international collaborations keeps it in the spotlight, even as concrete price movements remain elusive.

XRP Breakout Signals Bullish Market Shift Amid Strong Buying Pressure

Ripple's XRP has decisively broken above a key wedge pattern, confirming a bullish structural shift. The rally follows sustained buying pressure NEAR the $2.7 support level, where the 100-day moving average converged with the wedge's lower boundary.

Traders anticipate potential retests of the $2.9 breakout level before further upside. Immediate resistance lies at $3.4-$3.6, while failure to hold $3 could trigger a corrective pullback. The 4-hour chart shows buyers testing a critical supply zone at $3, with rejection candles suggesting ongoing liquidity battles.

XRP Price Stays Strong – Can Bulls Fuel Another Surge?

XRP price shows resilience as it consolidates above the $2.950 support level, with potential for another upward push. The cryptocurrency has outperformed Bitcoin and ethereum recently, breaking through key resistance levels.

A contracting triangle pattern on the hourly chart suggests continued bullish momentum if the $2.9150 support holds. Market watchers eye the $3.050 resistance as the next critical test for XRP's upward trajectory.

The 100-hourly Simple Moving Average provides additional technical support, while the 50% Fibonacci retracement level from recent lows offers a potential springboard for further gains. Kraken exchange data indicates healthy trading activity around these key levels.

Major Ripple Rally Ahead? XRP Eyes Explosive Move After Triangle Breakout

XRP is testing a critical technical threshold at $2.95, the upper boundary of a descending triangle pattern that has constrained its price action since late July. A confirmed breakout could propel the asset toward $3.60, according to Fibonacci projections, while failure risks a retracement to $2.75 support.

Futures markets show heightened anticipation, with open interest swelling to $7.94 billion. This positioning comes after 280 days of consolidation, during which trading volume patterns have built a coiled-spring technical setup. Analyst Ali Martinez notes the $3.10-$3.40 band may present interim resistance before any push toward higher targets.

The market lacks decisive confirmation, however. Recent daily closes have failed to establish directional conviction, leaving traders awaiting clearer chart signals. A breakdown below $2.65 would invalidate the bullish scenario entirely.

Ripple’s Trading Volume Explodes 200%, Can XRP Breach $4?

Ripple’s native token XRP saw its 24-hour trading volume surge 200% on Tuesday, hitting a weekly high of $3.03 billion. Daily volume, previously at $1.7 billion earlier in the week, breached the $5 billion threshold. The spike follows the impending expiration of XRP call options in September, prompting investors to cash out profits.

Options traders initially placed strike calls at $3, $3.50, and $4 for contracts maturing this September. Deribit Amberdata shows roughly 2 million contracts set to expire by September 28, 2025. As traders unwind positions, XRP has slipped below $3, now consolidating near $2.95. Further downside is likely until September’s options expiry passes—volatility demands caution.

The $4 target appears elusive. June’s $4 strike calls peaked at $3.65, XRP’s all-time high. Market structure suggests resistance will hold absent new catalysts.

XRP Faces Resistance at $3 as Institutional Selling Dampens Rally

XRP's upward momentum faltered near the psychologically critical $3.00 level, with institutional sell orders triggering a retreat to $2.94. The token briefly touched $3.035 during September 9-10 trading before encountering fierce resistance between $3.02-$3.04—a zone that previously capped gains in July.

Trading volume spiked to $165.67 million during a 14:00 sell-off, nearly triple the daily average, before activity tapered into consolidation. While RSI shows early bullish divergence and $2.94 holds as short-term support, swollen exchange reserves suggest lingering distribution pressure.

Market participants now await two potential catalysts: the Federal Reserve's anticipated 25bps rate cut on September 17, which could inject liquidity into risk assets, and the SEC's October review of six XRP spot ETF applications—a decision that may unlock institutional demand.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP shows strong potential to reach $3.40 in the near term, with a possibility of testing $4.00 if bullish momentum continues. The price currently at $2.9765 is trading above the critical 20-day moving average support of $2.9140, while Bollinger Bands suggest resistance near $3.13.

| Price Level | Significance | Probability |

|---|---|---|

| $3.13 | Bollinger Upper Band Resistance | High |

| $3.40 | Technical Target | Medium-High |

| $4.00 | Psychological Resistance | Medium |

| $2.70 | Bollinger Lower Band Support | Low |

BTCC financial analyst Michael states, 'The combination of strong technical positioning, institutional adoption scenarios, and Ripple's positive fundamental developments creates an environment where $3.40 appears achievable, with $4.00 becoming plausible if trading volume sustains current explosive growth patterns.'